|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Calculator Home Loan Refinance: A Comprehensive GuideRefinancing your home loan can be a savvy financial move, potentially saving you a significant amount on interest payments over time. A calculator home loan refinance tool can help you make informed decisions by comparing different scenarios and rates. Understanding Home Loan RefinancingHome loan refinancing involves replacing your existing mortgage with a new one, often with better terms. This process can help reduce monthly payments, lower interest rates, or change the loan term. Benefits of Refinancing

Using a Refinance CalculatorA refinance calculator is a valuable tool that estimates your potential savings. By inputting details like your current loan balance, interest rate, and new loan terms, you can see the impact of refinancing on your finances. Steps to Use a Calculator

For those with excellent credit, exploring the best refinance rates for excellent credit can further maximize benefits. When to Consider RefinancingRefinancing isn’t always beneficial. Consider it when:

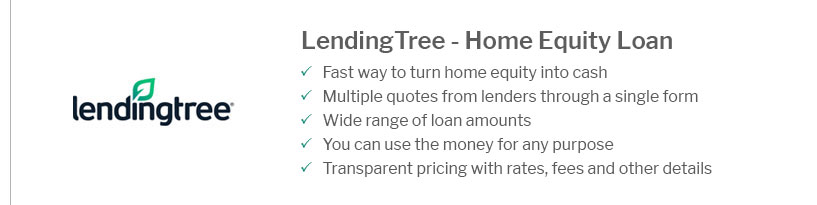

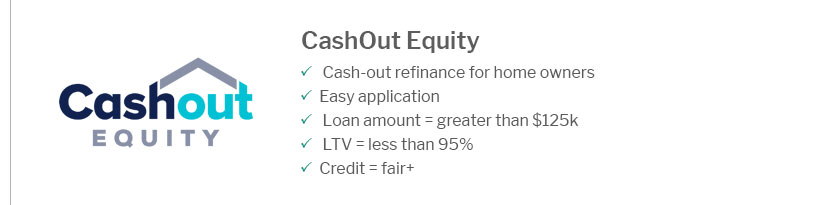

Additionally, for those interested in accessing equity, investigating the best refinance rates with cash out can provide valuable insights. Frequently Asked QuestionsWhat is the primary advantage of using a refinance calculator?The primary advantage is the ability to quickly and accurately assess potential savings and costs associated with refinancing options. How often should I consider refinancing my home loan?You should consider refinancing when market conditions change significantly, such as a drop in interest rates, or when your financial situation improves. Are there any risks associated with home loan refinancing?Yes, refinancing can involve costs such as closing fees and can extend your loan term, potentially leading to higher overall interest payments if not managed carefully. https://www.zillow.com/mortgage-calculator/refinance-calculator/

To calculate the value of refinancing your home, compare the monthly payment of your current loan to the proposed payment on the new loan. Then use an ... https://www.mortgagecalculator.org/calculators/should-i-refinance.php

Should I Refinance My Mortgage? Is your current interest rate on your house too high? Use this free tool to view today's best home loan refi rates from top ... https://www.bellco.org/calculators/home-refinance-calculator/

Home Refinance Calculator. Use this calculator to figure out how much you could reduce your monthly and total loan payments (principal + interest) if you ...

|

|---|